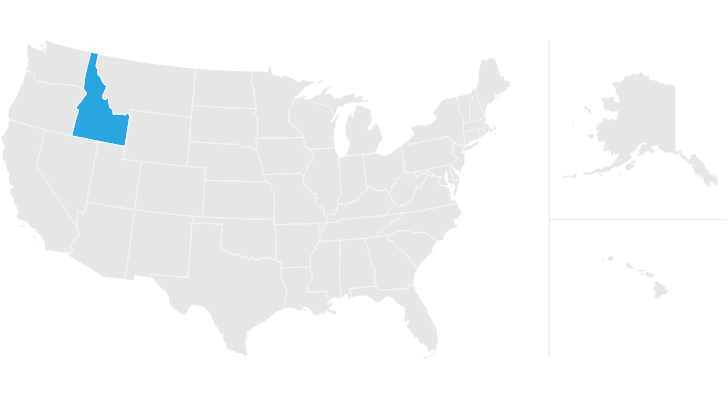

is idaho tax friendly to retirees

More examples of Idaho sources of income. Taxes are inevitable in some form no matter if you are a civilian or military retiree or wherever you may live.

For nature lovers and those looking to retire in a place that offers the feeling of being far away from the rat race this may be the place.

. Idaho is one of the most tax-friendly states in the country for retirees. Recipients must be at least age 65 or be classified as disabled and at least age 62. Exemptions exist for some federal state and local pensions as well as certain Canadian OAS QPP and CPP benefits.

The state of Idaho offers many veteran benefits including. Part 1 Age Disability and Filing status. Social Security income is not taxed.

There is no state income tax and the sales tax is relatively low. Then discuss your retirement journey with your Ameriprise financial advisor. The recipient of the retirement benefits must be at least 65 years old OR be classified as disabled and at least 62 years old.

If youre a military member temporarily assigned to idaho. Other retirement income is fully taxed but there is a deduction available to reduce taxes on retirement income of around 54000 108000 for joint filers for those 75 and older. But income tax is the 4th highest on the list.

In this case the state is coming in at 6 due to it being quite tax friendly for retirees. Use the instructions for. Contact Fool Wealth to learn how.

In a state like Wyoming which has no income tax along with low sales and property taxes retirees can expect to have a very small tax bill. Find specific information relating to any retirement benefits youre receiving in the Instructions Individual Income Tax. Idaho Property Tax Breaks for Retirees For 2022 homeowners age 65 or older with income of 32230 or less are eligible for a property tax reduction of up to 1500.

While potentially taxable on your federal return these arent taxable in Idaho. Idaho does their taxes the exact way i prefer low property and sales tax and a bit higher on the income side. Youll get the opportunity to breath and enjoy the raw beauty of nature.

The state taxes all income except Social Security and Railroad Retirement. Yes Is Idaho Tax-Friendly at Retirement. Learn about how idaho taxes retirement income the food tax credit and the three ways to save money on your property taxes.

For those ages 69 - 74 this. Social Security income is not taxed. Ad Get our free guide and discover 6 post-retirement income streams you may need to tap into.

Retirement income exclusion from 35000 to 65000. Idaho considers the following individuals to be disabled. What other tax exemptions exist.

Your retirement can survive inflation. Tax friendly states charge fewer taxes that might apply to retirees like income tax capital gains tax property tax and sales tax. The Idaho Retirement Benefits Deduction may be available to retirees who are both disabled and receive a qualifying source of retirement income.

As a service members spouse you may qualify for the federal Military Spouses Residency Relief Act SR 475 HR 1182 which was passed in November 2009. It was ranked 9 th for healthcare and 8 th best states for military retires in terms of number of VA health facilities veterans per capita and job opportunities for veterans. Low property tax is especially important for many retirees who may live in larger homes but have limited income streams.

Retirees benefit from a relatively low property tax and no tax on Social Security income in Idaho. The state of Idaho offers many veteran benefits including. To determine the top 25 tax-friendly state for retirees GOBankingRates examined data from the Tax Foundation on each states 1.

Idaho allows for a subtraction of retirement income on your state return if the taxpayer meets both parts of the two-part qualification that the state requires. Youre married to a service member whos serving in Idaho and has registered in the military with another state as a home of record. The Act exempts you from paying income tax if.

States like Alaska Floriga Georgia and Nevada are some of the tax-friendliest for retirees. Property taxes are also very reasonable and there are a number of exemptions and credits available for seniors. Ad Get started and take the 3-Minute Confident Retirement check to start finding answers.

State sales and average local tax. On the other hand taxes in a state like Nebraska which taxes all retirement income and has high property tax rates the overall state and local tax bill for a senior could be thousands of dollars higher.

Idaho Senate Passes Property Tax Reduction For Seniors

2022 Best Places To Retire In Idaho Niche

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

Idaho Estate Tax Everything You Need To Know Smartasset

21 Pros And Cons Of Retiring In Idaho Retirepedia

Moving From Washington To Idaho Benefits Cost How To

These Are The 10 Best States To Live In America American History Timeline States In America Life Map

Idaho Retirement Tax Friendliness Smartasset

Idaho Retirement Tax Friendliness Smartasset

Fold Out Road Maps Road Trip Planning Idaho Trip

4 Best Places To Retire In Idaho On A Budget

Retirees Aren T Moving To Idaho For Its Taxes Idaho Business Review

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

18 Pros And Cons Of Retiring In Idaho 2020 Aging Greatly

Surprising Data Reveals The Top 25 Tax Friendly States To Retire Gobankingrates

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio